The policy does not apply to employees recruited on fixed term contracts of less than 2 years duration, and therefore such requests cannot claim relocation expenses.

The policy will only apply to employees taking up their first appointment with Rotherham Metropolitan Borough Council, who when appointed:

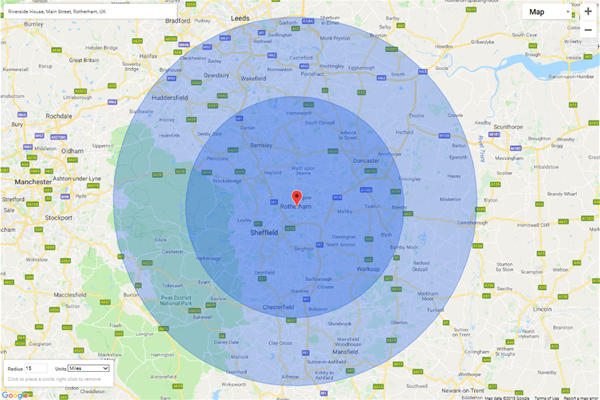

- Their existing home is more than 25 miles from your proposed place of work.

- Their new home is within a distance of not more than 15 miles of your place of work.

- Will travel a distance of not less than 20 miles between their new and old properties.

Where an employee claims travel and lodging allowances on the basis that they intend to relocate and subsequently changes their mind, they will be responsible for any income tax and national insurance arising.

Claimable expenses

The following may be claimed, please note original receipts must be provided:

- Removal expenses (based on the lowest of three written quotations)

- Storage and insurance expenses

- Professional fees incurred in the sale and purchase of a property for example estate agents, solicitors, search fees, valuation fees and mortgage indemnity insurance.

- Reasonable lodging expenses, where the claimant is still paying a mortgage or rent on their old residence outside of Rotherham, whilst they are seeking permanent rented accommodation or a home to purchase.

- Travelling incurred whilst seeking new residence in the Rotherham area or for home to work mileage during that time up to £60 per week to a maximum of £3,000 (that is for no more than 50 weeks). Travel costs can be claimed at the Council’s mileage rate or public transport costs

- Cost of replacement of domestic goods (for example curtains, cooker and carpets) that cannot be moved or adapted for the new home, less any amount received for the replaced goods.

The maximum amount that can be claimed under this scheme will be restricted to £8,000 (inclusive of VAT).

How to make claims

The Council will only make payments to the claimant for expenditure that is supported with VAT receipts. Employees must submit completed claim forms with receipts attached. After verification of the claim payment will be made through payroll to the employee.

Time limits

The Council will pay for expenses claimed by the end of the tax year following the one during which the employee started their new job. This time limit will apply to all claims whether or not tax or NI contributions are paid.

Any extension would need to be agreed between the taxpayer and HMRC officials

Repayment

If an employee leaves the Authority voluntarily then payments made under this scheme will be repaid on the following basis:

- Less than two years completed service - 100%

- Less than three years completed service - 50%

Notes

More detailed guidance on income tax and national insurance when an employer assists with the costs of moving house can be obtained on the HMRC website.

Mile radius

Map detailing the 25 and 15 mile radius from Riverside House, Main Street, Rotherham, S60 1AE