What happens if you don't pay your Council Tax

Reminders

Text Message Reminder

Where we hold your mobile phone number but your payments are not made on time we will aim to send you a text message before issuing a reminder, final notice or summons, asking you to bring payments up to date. Providing you make the payment requested by the date shown on the text you do not need to contact the Council.

You can make a payment by clicking the link within the text message. To be confident you are accessing a genuine message from the Council, some example images are below.

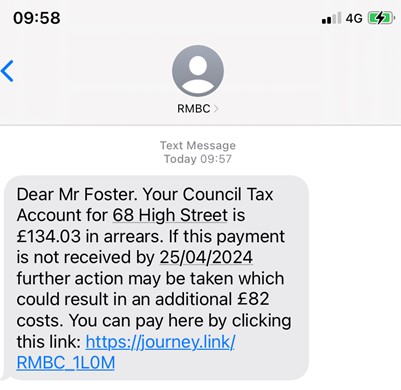

An example of a reminder text message:

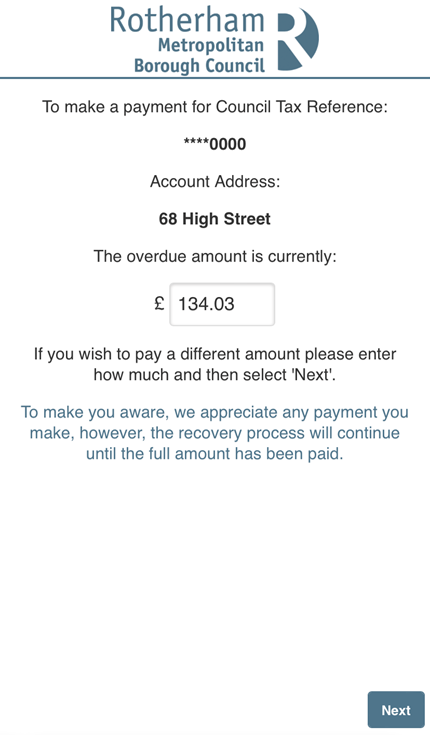

This is how the page should look once you follow the link from the message:

After proceeding, you will be asked for your card details to make the payment.

Once a payment has been made, confirmation will appear like this:

You will then receive a text confirmation from the same contact as before.

Paper Reminder

If you don’t pay your Council Tax on time you will receive a reminder notice. There is no charge for a reminder notice.

If you pay the amount requested on the reminder notice within 7 days from the date on the reminder and make your future payments on time, you do not need to contact the Council.

If you don’t pay, then you will be issued with a summons and you will lose your right to pay by instalments as well as incurring an additional £56.00 charge.

Second Paper Reminder

If you fail to pay on a second occasion in the same financial year, then you will receive another reminder notice. There is no charge for this reminder notice.

If you pay the amount requested on the reminder notice within 7 days from the date on the reminder and make your future payments on time, you do not need to contact the Council.

If you don’t pay, then you will be issued with a summons and will you lose your right to pay by instalments as well as incurring an additional £56.00 charge.

Final Notice

If you receive more than two reminder notices within a financial year, then you will lose the right to pay by instalments and a final notice will be issued for the remainder of the Council Tax owed for the financial year.

If you pay the amount requested, then there will be no additional charges incurred and you do not need to contact the Council.

If you don’t pay then you will be issued with a summons, incurring an additional £56.00 charge.

Summons

If you don’t pay the amount on a reminder or a final notice then you will be issued with a summons, which incurs an additional charge of £56.00. The summons will advise you of your Magistrates Court hearing date.

At court, the Council will apply for a Liability Order plus an additional £26.00 costs. The Liability Order provides the Council with extra powers to collect unpaid Council Tax.

If you pay the summons in full before the hearing date, including the £56.00 additional costs, then no application will be made for a Liability Order and you do not need to contact the Council or attend court.

You have a right to attend the court hearing, but you should only do so if you have a valid defence to the Liability Order application. The most common defences are:

- The Council has not asked for Council Tax to be paid in accordance with Council Tax legislation.

- The amount on the summons has been paid, including costs.

It is not considered a valid defence when:

- You cannot afford to pay the amount in full.

- You have applied for Council Tax Support and have not yet heard if you have been successful.

- You are querying the amount of Council Tax Support you have been awarded.

- You have appealed to the Valuation Office agency against your Council Tax band.

- You have appealed the Councils decision to hold you liable to pay Council Tax.

It is not necessary to attend court if you are looking to discuss an arrangement to pay the balance. The Magistrates cannot make an arrangement with you to pay but you can make an offer of payment to the council before the court hearing date.

Alternatively, you can text the word OFFER to 07860019682 to be sent an Offer of Payment form to your phone.

If an arrangement is accepted your case will still be listed at the court hearing where we would ask for the Liability Order and additional costs of £26.00. However, no further recovery action would be taken against you providing the agreed repayments are maintained.

Liability Order

If a Liability Order has been obtained but no repayments agreed, the Council will use the additional powers provided by the Liability Order to recover the debt in full. This could involve:

Ordering your employer to take money directly from your wage (Attachment of Earnings Order).

Requesting money directly from your benefits (Attachment to Benefit).

The use of Enforcement Agents to collect the debt on the Councils behalf which could result in the removal and sale of your goods.

Securing the debt against any property you own through a Charging Order and in some cases forcing sale of the property.

Commencing proceedings to make you bankrupt.

Applying to the court for your committal to prison for a period of up to 90 days.

Before any of these further recovery steps commence, you can pay the debt in full to prevent them.

Alternatively, it may still be possible to agree repayments and avoid the recovery steps shown above.

Alternatively, you can text the word OFFER to 07860019682 to be sent an Offer of Payment form to your phone.

If you cannot afford to pay your Council Tax it is important that you contact the Council to discuss your situation.